Are you looking for the best personal finance apps in Dubai? Managing finances can be stressful, but with the right app, it’s easier than ever. In this blog, we’ll go over the top six personal finance apps to help you keep track of your finances and improve your financial health.

Benefits of Personal Finance Apps

First, let’s talk about the benefits of using personal finance apps. These apps offer convenience, cost-effectiveness, organization, and time-saving benefits. They make it easy to keep track of your expenses, create budgets, and monitor your investments.

Factors to Consider When Choosing Your Personal Finance App

When selecting a personal finance app, you should consider its user interface, features, security, and customer support. Let’s take a closer look at each of these factors:

User Interface

A good personal finance app should have a user-friendly interface that is easy to navigate. Look for an app that presents information in a clear and concise way, with intuitive controls and a visually appealing design.

Features

The features offered by a personal finance app will vary depending on the app. Some common features include budget tracking, investment tracking, automatic expense tracking, financial goal setting, and personalized financial advice. Consider which features are most important to you when choosing an app.

Security

Since personal finance apps deal with sensitive financial information, security is a critical consideration. Look for an app that uses encryption and other security measures to protect your data.

Customer Support

In the event that you have a question or encounter a problem with the app, good customer support can make all the difference. Look for an app that offers responsive customer support through multiple channels.

Top Personal Finance Apps in Dubai

Now, let’s dive into the top personal finance apps in Dubai.

Mint

At number one, we have Mint, an app that offers budget tracking, investment tracking, and personalized financial advice. Users love its intuitive interface, automatic expense tracking, and the ability to create and manage financial goals. Some complain about the occasional syncing issues and limited features for investment tracking.

YNAB (You Need A Budget)

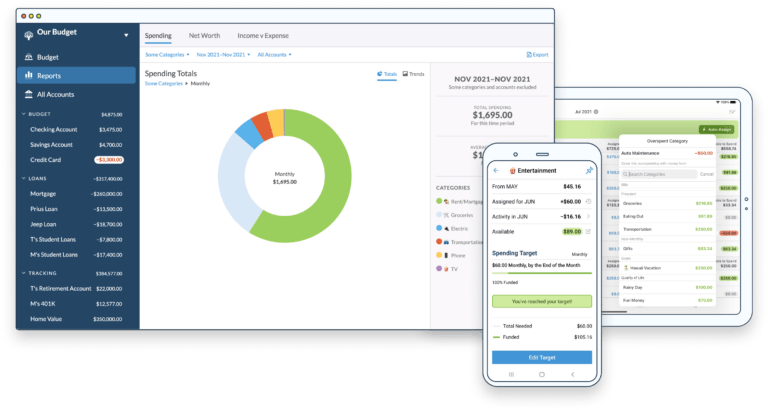

Next up, YNAB has a unique approach to budgeting that focuses on allocating funds to specific categories. Users love how it helps them plan for future expenses, reduce overspending, and achieve their financial goals. However, some users find the learning curve to be steep and the app’s inflexibility to be a drawback.

PocketGuard

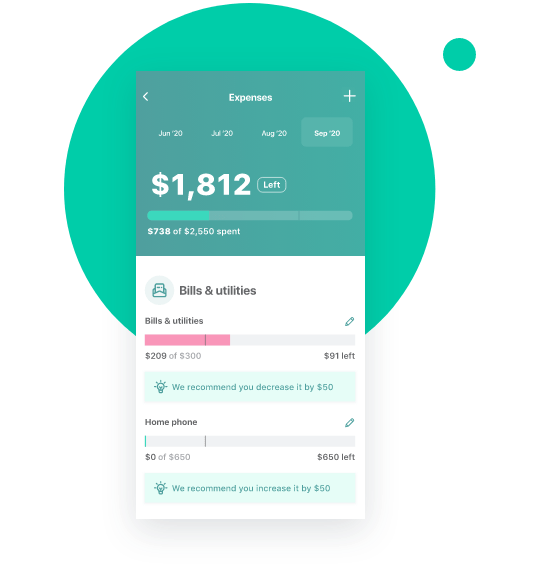

And at number three, PocketGuard provides users with a comprehensive view of their finances in one place, including bank accounts, credit cards, loans, and investments. Users praise its ease of use, ability to track expenses, and customizable budget categories. Some users report issues with the app’s transaction categorization and limited support for foreign currencies.

Other Personal Finance Apps to Consider

If those three don’t quite fit your needs, don’t worry. There are other personal finance apps in Dubai to choose from, such as Toshl Finance, MoneyLion, and Wally. These apps offer different features, pros, and cons, so it’s worth doing your research to find the best fit for you.

Conclusion

In conclusion, the best personal finance app for you depends on your specific needs. By considering the user interface, features, security, and customer support, you can find the app that suits you best. With the right app, managing your finances can be a breeze, giving you more time to focus on the things you love. So, what are you waiting for? Start exploring the best personal finance apps in Dubai today.

3 thoughts on “Top 6 Best Personal Finance Apps in Dubai for Better Money Management”